Archived article

Please note that tax, investment, pension and ISA rules can change and the information and any views contained in this article may now be inaccurate.

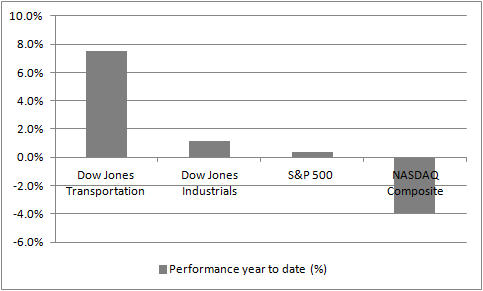

For the moment, it seems, transportation stocks are taking flight and at the same time sending the bears scurrying for cover. One of this column’s favourite market indicators – the Dow Jones Industrial Transportation index – is now up on the year as are two of America’s broader indices, Dow Jones Industrials, S&P 500, although the tech-laden NASDAQ Composite is still slightly down.

Source: Thomson Reuters Datastream

NOTE: Past performance is not a guide to future performance and some investments need to be held for the long term.

Our own FTSE 100 and FTSE All-Share are not quite in such robust shape, as they are still down for the year, but the Industrial Transportation index is the eleventh-best performing sector out of 39 so far this year, which is usually no bad thing.

| Performance, year to date (%) | |

| Mining | 27.0% |

| Industrial Metals | 24.9% |

| Food & Drug Retailers | 18.2% |

| Oil Equipment & Services | 11.1% |

| Oil & Gas Producers | 9.3% |

| Industrial Engineering | 9.1% |

| Personal Goods | 6.4% |

| Tobacco | 5.7% |

| General Industrials | 5.6% |

| Leisure Goods | 5.2% |

| Industrial Transportation | 5.0% |

| FTSE All-Share | -1.7% |

Source: Thomson Reuters Datastream, Shares Magazine

NOTE: Past performance is not a guide to future performance and some investments need to be held for the long term.

The trick now for investors is to divine why this might be and whether the rally has its roots in

- A genuine acceleration in global economic activity, potentially fired (at last) by the benefits of a falling oil price

- Or increased risk appetite in markets, assisted by further monetary policy intervention from the European Central Bank, the People’s Bank of China and less aggressive line on interest rate rises from the US Federal Reserve

If cheap oil is helping then the irony is the price of crude has rallied 50% from its lows, amid expectations that an April summit between OPEC and non-OPEC producers in Qatar will lead to production freezes. Equally, only a month ago markets were fretting about the potency of central bank policy after seven to eight years of record-low rates and Quantitative Easing, so both themes will require close scrutiny in the coming weeks and months to see if this stock and commodity price rally can persist or not.

Planes, trains and trucks

The 30-stock Dow Jones Industrials may be better known but history shows it goes nowhere fast if the Transport index is stuck in neutral or reverse and can power ahead when the Transports are in fine fettle.

According to Richard Russell's Dow Theory, it can only be good news if the share prices of the firms shipping goods around America are doing as well or better than those of the firms making them, as this suggests business is accelerating. If something is sold, it has to be shipped. Equally, weak transport stocks could mean inventories are piling up on shelves and forecourts, to herald production cuts and a potential downturn in industrial activity.

Throughout 2015, the Dow Jones Transportation index refused to lead the Dow Jones Industrials higher. This year currently offers a different – and more encouraging – picture.

Dow Jones Transportation index is leading the Industrials higher

Source: Thomson Reuters Datastream

NOTE: Past performance is not a guide to future performance and some investments need to be held for the long term.

In the UK, the FTSE All-Share Industrial Transportation index has a similar relationship with the FTSE All-Share itself.

FTSE All-Share Industrial Transportation index is also leading the broader market

Source: Thomson Reuters Datastream

NOTE: Past performance is not a guide to future performance and some investments need to be held for the long term.

Deep waters

This all seems very encouraging but there are some contradictory signals which need to be borne in mind.

Shipping giant Maersk’s shares remain under pressure

Source: Thomson Reuters Datastream

NOTE: Past performance is not a guide to future performance and some investments need to be held for the long term.

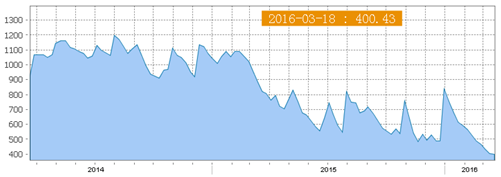

- As if to confirm Maersk’s gloomy prognosis of the actual business environment the Shanghai Containerised Freight Index is plumbing new depths at around the 400 mark, having already halved this year.

Chinese shipping index stands at low levels

Source: Shanghai Shipping Exchange

NOTE: Past performance is not a guide to future performance and some investments need to be held for the long term.

- At least the Baltic Dry index is making some progress. This indicator takes in 23 shipping routes on a time charter basis and looks at the rates for moving commodities such as grain, iron ore and coal around the globe. However, it remains mired near record lows.

Baltic Dry index is trying to rally from historic lows

Source: Thomson Reuters Datastream

NOTE: Past performance is not a guide to future performance and some investments need to be held for the long term.

- Even after a rally, shares in Textainer, the world’s largest container shipping company, are stuck near the lows seen in 2009, when the global economy was just wobbling its way out of the financial crisis.

Textainer shares are trading near lows seen during the past downturn

Source: Thomson Reuters Datastream

NOTE: Past performance is not a guide to future performance and some investments need to be held for the long term.

These are signals which do not sit easily with the general rally in headline transport and equity indices, especially as the world trade data published in the CPB Netherlands Bureau for Economic Analysis’ World Trade Monitor shows a marked slowdown in global trade volumes at the end of 2015.

World trade flows slowed markedly in late 2015

Source: CPB Netherlands Bureau for Economic Analysis World Trade Monitor

NOTE: Past performance is not a guide to future performance and some investments need to be held for the long term.

Roll out the barrel

Regrettably more recent data is not yet available and it must be borne in mind that financial markets are forward-looking discounting mechanisms. They are currently pricing in improved trade and economic activity, not a further deterioration.

Again, this may be due to a renewed bout of faith in central banks after the latest round of European interest cuts and QE packages. If so, all this column can say is good luck with that, as the experiences of the last eight years in the US and UK, and 20 years in Japan, suggest the benefits are fleeting at best.

More tangibly, weak oil prices could finally be filtering through to consumers’ pockets. UK food and drug retailers are finally showing some like-for-like sales growth. As a result, Tesco and Morrisons are both among the top ten performers in the FTSE 100 for 2016 so far and Food & Drug Retailers is the third best performing sector of 39.

This may be the first sign of the oil price windfall. As this column has noted before, history suggests recessions are not caused by weak oil prices, but strong ones and that economic growth tends to accelerate after crude takes a hammering. The coming months will tell us whether this historic relationship can be maintained or not. If so, it may be to the potential benefit of the spring share price surge.

Weak oil prices have historically helped rather than harmed global growth

Source: Evergreen Gavekal

NOTE: Past performance is not a guide to future performance and some investments need to be held for the long term.

Russ Mould

AJ Bell Investment Director

Related content

- Wed, 17/04/2024 - 09:52

- Tue, 30/01/2024 - 15:38

- Thu, 11/01/2024 - 14:26

- Thu, 04/01/2024 - 15:13

- Fri, 17/11/2023 - 08:59