What a commodities price surge tells us about Nvidia and the markets

While the relentless advances in Nvidia (NVDA:NASDAQ), Bitcoin and US equities continue to grab most of the headlines (and that is not forgetting new all-time highs for headline stock indices in France, Germany, Taiwan, Australia and Japan), one asset is outstripping them all so far in 2024 – and that is cocoa. Futures prices for the commodity have melted up by almost 150% this year alone, to a new record high of nearly $10,000 a tonne, thanks to disease and bad weather in leading producers Ghana and the Côte d’Ivoire (amid some accusations of hedge funds piling in, for good measure).

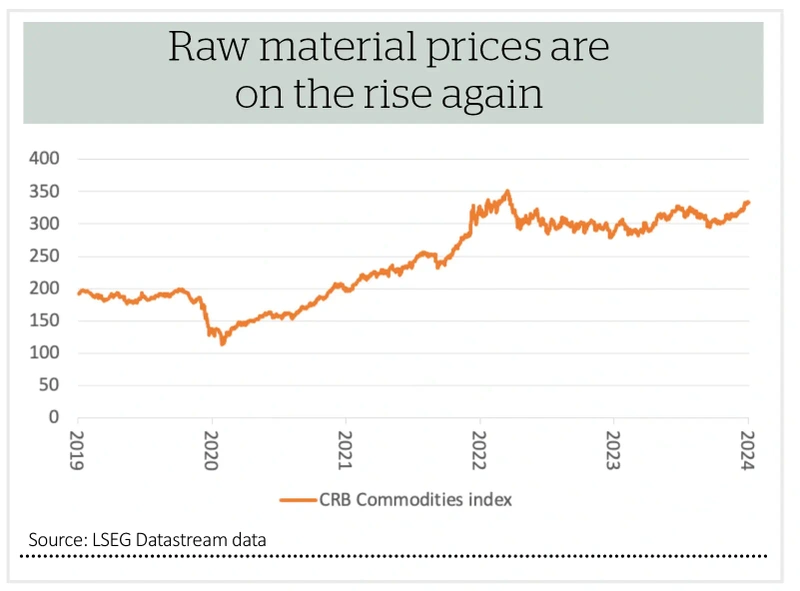

This column can offer no cogent view on cocoa, but it does note how the CRB Commodities index, a benchmark based upon the price of 19 raw materials, spread across energy, agriculture and industrial and precious metals, is on the verge of setting a new five-year high.

Perhaps this is a sign that the global economy may be in better nick than many believe, or at least that it is back on track after the chaos caused by the pandemic, lockdowns, clogged shipping lanes and fractured supply chains over the past four years. Equally, it could be the markets’ way of saying that central banks are in danger of playing with fire if they cut interest rates too early.

DOCTOR COPPER

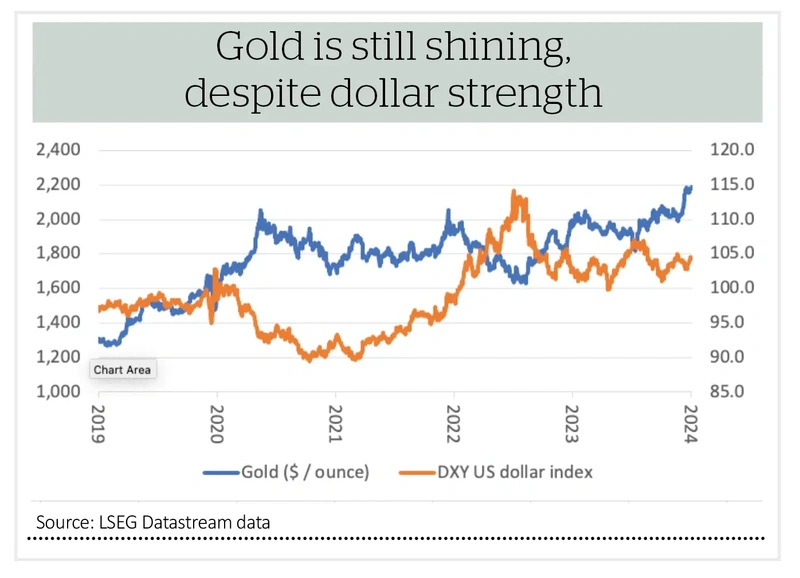

One potential sign of such concerns is how gold is on the rise even as the US dollar remains firm, which is an unusual combination of events.

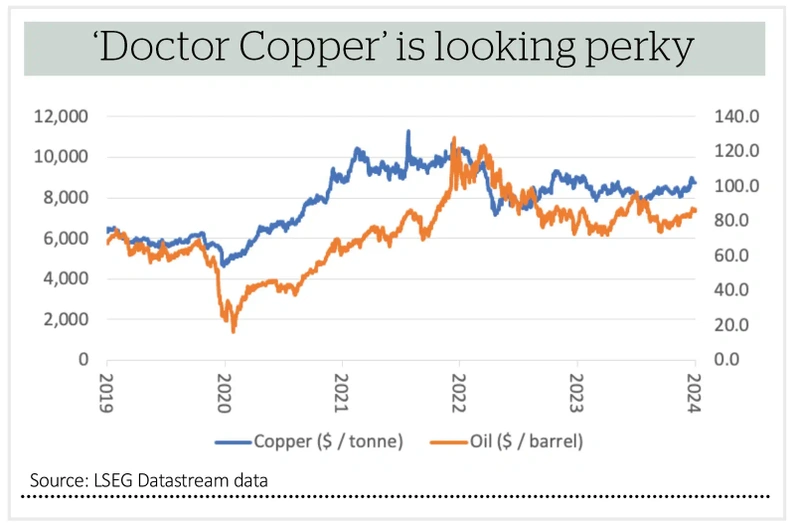

Copper and oil are both on the march as well. The industrial metal is nicknamed ‘Doctor Copper,’ because it is used so widely, thanks to its malleability, ductility and conductivity, and is therefore seen by many market watchers as a good guide to global economic health.

Whether we like or not, oil demand continues to grow. While we must consider the vested interests of the source, OPEC believes the world will consume 104.5 million barrels of oil a day in 2024, with a further increase to 106.3 million in 2025, a level 6% above that seen in the pre-pandemic year of 2019. Thanks to the oil price collapse of the mid-late 2010s, and the panic of 2020, as well as political and public pressure to deemphasise hydrocarbons, capital investment in new output remains relatively restrained and supply growth is due to be modest, especially as OPEC is sticking to its production cuts.

If raw material prices surge once more that could feed into producer price and finally consumer price inflation, in an uncanny echo of the waves of inflation suffered by the US and UK in the 1970s (when oil price shocks had a major part to play, thanks to the geopolitical after-effects of the 1973 Yom Kippur war and the fall of the Shah of Iran in 1979).

Making investment decisions based solely on geopolitics is rarely wise, not least as none of us has a crystal ball and the range of possible outcomes is huge. Nor does anyone really wish to think in terms of the conflicts in Ukraine and the Middle East getting worse. But having some sort of hedge against such a tail risk is at least worthy of consideration, especially as Nvidia’s current market capitalisation is the equivalent to that of all seven of the West’s oil and gas majors, with more than $650 billion in change left over (even once you take on board all of their cumulative net debt as well).

Clearly the market’s thinking here is that 6% growth in demand from 2019 to 2025 is a huge yawn when compared to what Nvidia may have to offer thanks to the AI boom. Such logic is hard to refute, especially when the long-term drive toward renewable energy is considered, but there are two other considerations here.

The first is that share prices, at least in the short term, move according to how profits and cash flow are delivered relative to expectations (and right now little is expected of oil firms and a lot is required of Nvidia). The second is that AI and its legion of servers and data centres will require a colossal amount of power to keep them whirring away and right now oil, gas and coal provide 60% of the world’s electricity, according to analysis by Ember.

Important information:

These articles are provided by Shares magazine which is published by AJ Bell Media, a part of AJ Bell. Shares is not written by AJ Bell.

Shares is provided for your general information and use and is not a personal recommendation to invest. It is not intended to be relied upon by you in making or not making any investment decisions. The investments referred to in these articles will not be suitable for all investors. If in doubt please seek appropriate independent financial advice.

Investors acting on the information in these articles do so at their own risk and AJ Bell Media and its staff do not accept liability for losses suffered by investors as a result of their investment decisions.

magazine

magazine