Why the market has soured on Apple: Can the tech giant turn things around?

This year, Apple (AAPL:NASDAQ) shares have fallen nearly 9%. If that doesn’t sound like a big deal, consider that for the world’s second most valuable company it means the loss of something like $230 billion. That’s the equivalent of an entire PepsiCo (PEP:NASDAQ), or Shell (SHEL) – the UK’s current largest company – plus a British American Tobacco (BATS) thrown in.

On a one-year view, the stock has recorded a total return (share price performance plus dividends) of 2.67%, according to Morningstar data, versus nearly 35% of the Nasdaq Composite. It is not what investors have come to expect from the Cupertino tech colossus, a shocking showing compared to the near 25% a year racked up over the past decade.

Peering into the forecast future, analysts see little better than 1% growth in revenue this financial year (to 30 September) and a mere 6.5% in fiscal 2025, with no better anticipated for net profits. On a PE (price to earnings) multiple of close on 25 and a PEG of 3.3 (price to earnings growth), investors might well be wondering whether Apple’s best days are behind it and if the current $169.65 share price, and $2.62 trillion market cap, do not fairly reflect this.

But is this a true picture of Apple’s investment potential today? Analysts overwhelmingly still back the business and its shares. According to Koyfin data, of the 45 experts who follow the company, 26 (58%) are telling clients to buy the stock while only four (9%) have slapped sell recommendations on the shares (the rest are fencing-sitting holds).

The consensus price target stands at just over $200, implying around 18% upside over the next 12 months, while $250 tops the range, nearly 48% above the current level. And while it’s true that Warren Buffett’s Berkshire Hathaway (BRK.B:NYSE) sold around 10 million Apple shares late in 2023, Berkshire’s remaining 5.9% stake is worth roughly $155 billion (based on the current valuation) or about 17% of Berkshire’s $910 billion market cap. Quite the commitment.

WHAT’S HURTING APPLE RIGHT NOW?

Multiple factors have worked against Apple, the most recent its wrangling with regulators over its smartphone dominance. Antitrust legal challenges have become par for the course in the technology industry, and the (sometimes hefty) fines incurred are typically written off by analysts and investors as part of doing business.

But Apple now finds itself under threat on three of its most important fronts; Europe, China and now its own US backyard. In late March 2024, the US Department of Justice launched a lawsuit accusing the iPhone maker of violating antitrust laws and suppressing competition by blocking rivals from accessing hardware and software features on its devices.

The challenge saw Apple stock lose more than 4%, its biggest one-day fall since August 2023 according to Bloomberg. The sell-off this year stands in stark contrast to the rest of big tech. The US-listed Roundhill Magnificent Seven ETF, which tracks the performance of the ‘Magnificent Seven’ stocks, is up around 16% year-to-date, led by Nvidia (NVDA: NASDAQ) and Meta Platforms (META:NASDAQ), up 78% and 48% respectively.

Tesla (TSLA:NASDAQ), down 31%, is the only other ‘Magnificent Seven’ loser this year.

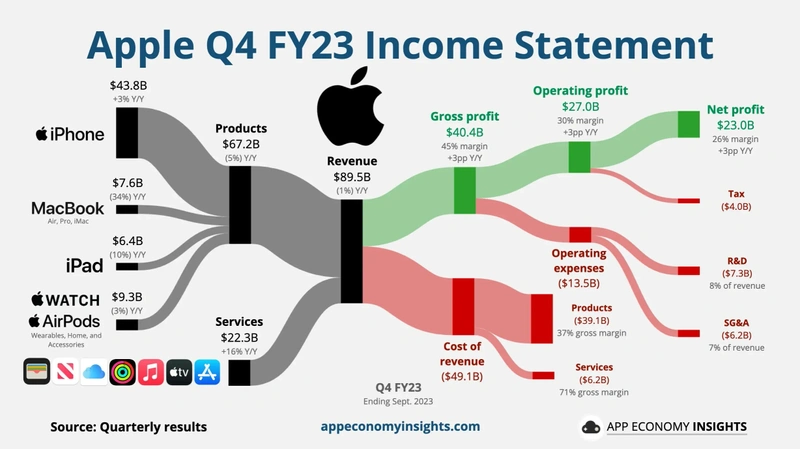

The US suit also puts Apple’s Services business in the watchdog’s crosshairs, the firm’s biggest source of growth in recent years. Home to the App Store, Apple Pay, Apple Music and other stuff, the Services arm is fed by more than two billion Apple devices in use. Services revenue expanded 9% in fiscal 2023 while product revenue, including iPhones, Macs and iPads, dropped 3%.

Despite accounting for just 22% of Apple’s sales, Services generated more than a third of profit making investors particularly sensitive to any regulatory attacks to the division.

But analysts urge shareholders against panic Apple stock selling. ‘We still believe most Apple users opt into the firm’s premium closed ecosystem, and we don’t predict significant attrition for the firm’s products and services even in a more open environment,’ says William Kerwin, analyst at Morningstar.

‘We assume the suit will result in some opening of Apple’s walled garden ecosystem, similar to what we expect from the European Union’s Digital Markets Act,’ adds Kerwin.

CRUCIAL IPHONE

Worries about iPhone demand are also keenly felt and underline a widely-held view that Apple has fallen way behind on the innovation front, leaving the iPhone to shoulder most of the growth burden, albeit with Services increasingly helping out.

The powerhouse of growth since the iPhone was launched in 2007, Apple arrested four straight quarters of revenue declines in the first quarter of financial year 2024 (released in early February) yet it continues to face challenges in China, its third largest market.

Chinese revenue fell 13% in the first three months of the year, declining to $20.82 billion and falling short of analyst estimates of $23.53 billion according to data from LSEG. China has been a major growth driver for Apple, but fierce completion from Huawei and Xiaomi and changing geopolitics are weighing, and investors’ concerns are mounting that the situation may not improve in 2024.

According to analysis of the supply chain for Apple’s smartphone production, the company has reduced orders for key semiconductor components for the iPhone in 2024 to about 200 million units, down 15% from the previous year. This is a key reason why many analysts have been trimming iPhone expectations this year and some are predicting Apple may experience the largest decline in sales among global smartphone brands.

Some are hoping a new iPhone 16, due for release in the last quarter of 2024 in time for the Christmas run-in, could arrest declines. However, consumers are increasingly demanding integrated generative AI features to justify splashing out on a new smartphone, and many analysts do not expect Apple to release new iPhone models with significant design changes and a more comprehensive and differentiated AI ecosystem applications before 2025.

Until then, this is likely to hurt iPhone shipments and the growth of the Apple ecosystem. Respected Apple analyst Ming-Chi Kuo, of TF International Securities, forecasts shipments of the iPhone 15 and the new iPhone 16 to decline by between 10% and 15% year-on-year in the first and second quarters of 2024, compared to shipments of the iPhone 14 line in the first quarter of 2023 and the iPhone 15 in the second quarter of 2023.

The launch of the Vision Pro multi-reality headset doesn’t look anything like a mass-market adoption option at $3,500 a pop, and the company had to fend off criticism it is heavy and uncomfortable when worn for very long.

None of this necessarily alters the longer-term potential of Apple and its ecosystem, but it does show how the company has fallen behind on the innovation race, as illustrated by its strange relative silence on AI.

WAITING FOR AI ANSWERS

Since generative AI capabilities were launched by OpenAI at the end of 2022, Apple has been worrying silent on its AI strategy, losing ground to the likes of Microsoft (MSFT:NASDAQ), Meta Platforms and Alphabet (GOOG:NASDAQ).

That, at least, seems to be changing. Having ditched its inhouse electric car fantasy – Project Titan – rumours suggest much of the technical talent tied up in that will now be shifted to an AI projects space, which sounds much more like Apple turf, led by executive John Giannandrea. If true, it would also demonstrate far more sensible capital discipline than chasing fancy moonshots.

We may learn more in June when Apple plans to kick off its annual Worldwide Developers Conference, where the company is expected to unveil its long-anticipated artificial intelligence strategy. Apple isn’t giving details away but people allegedly in-the-know say the presentation (10-14 June) will focus heavily on AI, and perhaps announce rumoured tie-ins with Google and China’s Baidu (BIDU:NASDAQ).

With an approximate two billion Apple devices worldwide ready to embrace whatever the company does, this is an exciting prospect. Perhaps an AI-powered Siri is one obvious option. But until we have answers about where AI fits in at Apple investors are likely to handle the stock with care.

There is no question the company has built a vast ecosystem with strong brand loyalty among its users, equating to a powerful profits machine. We would not recommend upending your portfolio with mass sales of Apple stakes, but the company needs something else to capture the imagination of consumers and investors.

Morningstar analysts estimate a fair value on the stock of $160 and have a ‘medium uncertainty rating’ following the US antitrust suit. That neatly sums up where we are with Apple right now.

Important information:

These articles are provided by Shares magazine which is published by AJ Bell Media, a part of AJ Bell. Shares is not written by AJ Bell.

Shares is provided for your general information and use and is not a personal recommendation to invest. It is not intended to be relied upon by you in making or not making any investment decisions. The investments referred to in these articles will not be suitable for all investors. If in doubt please seek appropriate independent financial advice.

Investors acting on the information in these articles do so at their own risk and AJ Bell Media and its staff do not accept liability for losses suffered by investors as a result of their investment decisions.

Issue contents

Feature

Great Ideas

News

- Britvic shareholders left feeling flat as stock price decline continues

- Shareholders in Pinewood Technologies set for bumper special payout

- Can Dunelm demonstrate there’s no place like home?

- Can Johnson & Johnson beat first quarter expectations again?

- Strong labour market continues to undermine case for Fed rate cuts

- UK finance officers are bullish which is good news for the economy

- Could rising oil prices derail interest rate cuts?

- What is Microsoft-backed Rubrik, the latest firm to IPO in the US?

magazine

magazine