Bloomsbury is more than just a successful publisher of sci-fi and fantasy books

Shares in publishing outfit Bloomsbury Publishing (BMY) hit a record level on 14 February after the firm raised its guidance for the year ending 29 February 2024.

Over the past year, Bloomsbury shares have gained 22% and over five years 137% to sit at 536p. The publisher has clearly benefited from the revival of reading which started during the pandemic and the ability to tap into popular genres like sci-fi and fantasy. Interest in these genres has grown by 54% over the past five years in the UK, according to data from UK Nielsen BookScan.

Bloomsbury chief financial officer Penny Scott-Bayfield tells Shares: ‘The fantasy genre has been important to us throughout. Our key [overall] focus is to publish books of excellence and originality across many genres and categories from academic, consumer, children, adult [books]. We began with Harry Potter nearly 30 years ago, we now have Samantha Shannon and Cixin Liu in the sci-fi space and now the global phenomenon that is Sarah J. Maas.’

HOW DOES BLOOMSBURY MAKE MONEY IN ITS CONSUMER DIVISION?

Founded in 1986 by current chief executive Nigel Newton, Bloomsbury really made its name off the back of the explosive success of the Harry Potter titles – enduring a fallow period in the 2010s as Pottermania faded. However, the pandemic reawakened peoples’ love of reading which, combined with some successful strategic initiatives and the canny capture of some winning authors, has helped propel the stock to its fresh all-time highs.

As a traditional publisher, Bloomsbury makes money from contracts and royalty payments and pays out advances to authors. For the first half of the financial year just ended Bloomsbury booked royalty payments of £15.9 million.

An advance amount is negotiated between the publisher and the author. If the author is new than the advance is lower, whereas if they are more established and successful then the advance is more.

Royalties are paid from book sales – commercial arrangements will vary but typically a publisher might take 10% to 15% of the cover price of a book. Bloomsbury has a sales and marketing division which helps promote and distribute the books on its roster.

The more copies a book sells, the more money the publisher makes. For example, Bloomsbury sells to retailers like Amazon (AMZN:NASDAQ) and Waterstones who in turn sell to the public. If a retailer then discounts certain titles then it does not typically impact how much Bloomsbury receives.

As well as making money from new authors, Bloomsbury makes money from selling its backlist of previously published titles such as Sarah J. Maas’ previous 15 books and J.K. Rowling’s Harry Potter titles.

Making titles available to buy online in a digital format is an effective way for the publisher to generate revenue from its backlist at limited additional cost.

Audio books represent another growth area. For the first half, Bloomsbury said sales for Sarah J. Maas and Samantha Shannon titles grew by 79% and 169% respectively.

Other bestsellers in Bloomsbury’s consumer division include Poppy Cooks: The Actually Delicious Air Fryer Cookbook by Poppy O’Toole, Pub Kitchen by Tom Kerridge and The House of Doors by Tan Twan Eng in the US.

What is Bloomsbury’s valuation?

Based on consensus forecasts for the 12 months to 28 February 2025, Bloomsbury shares trade on a price to earnings ratio of 16.5 times and offer a dividend yield of 2.5%.

HOW DOES BLOOMSBURY MAKE MONEY IN ITS NON-CONSUMER DIVISION?

The publisher also makes money from its non-consumer division by selling academic products like its Bloomsbury Digital Resources (BDR) subscription-based offering.

In the first half of the financial year to 29 February, Bloomsbury generated non-consumer revenue of £47.3 million and an underlying pre-tax profit of £5.9 million.

‘Academic publishing is attractive to us for several key reasons - the revenue stream is much more predictable, the margins are higher and there is also the digital channel upside potential - while in the consumer division print remains attractive,’ says Scott-Bayfield.

WHAT IS THE STRATEGY?

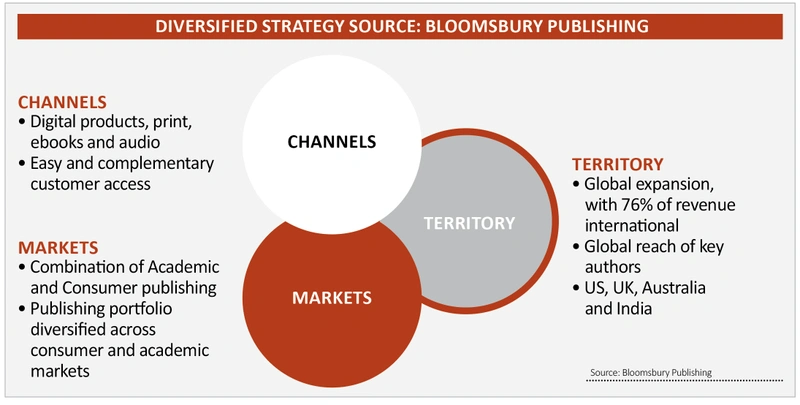

The strategy of combining consumer and non-consumer sales has proved a solid one in recent years. It has also meant Bloomsbury is not as reliant on the Christmas trading period when traditionally the bulk of book sales are been made.

The publisher’s new BDR target is to achieve a further 49% organic increase in revenue over the five years to 2027/2028 and reach approximately £37 million of turnover.

Bloomsbury’s latest trading update (14 February) saw it guide for revenue and pre-tax profit (and highlighted items) to be ‘significantly ahead’ of upgraded market expectations for the year ending 29 February 2024. These expectations were for revenue of £291.4 million and underlying pre-tax profit of £37.2 million. The company is due to report its full-year results on 23 May.

Backed by its strong balance sheetthe publisher has been on the acquisition trail since 2008 and has completed 19 deals since then.

In December 2021 the company bought ABC CLIO, a US academic publisher of reference books with ‘a major presence in the US high-school library market.’

A new platform for streaming academic content – Bloomsbury Video Library (BVL) – was also launched at the same time.

USING SOCIAL MEDIA

Some of the publisher’s success within the consumer division has been driven by its social media strategy around the books it is promoting.

Chief executive Nigel Newton has singled out TikTok and Instagram as social media platforms which have helped to propel sales. The BookTok phenomenon on the former is seeing young people share their passion for certain titles with millions of people around the world.

The publisher has also been capitalising on appetite for content from global streaming channels like Netflix (NFLX:NASDAQ). For example, Bloomsbury author Cixin Liu’s bestseller Three Body Problem will be adapted for film by Game of Thrones producer David Benioff and D.B.Weiss and aired through Netflix on 21 March.

What is free cash flow?

Free cash flow is cash a company generates through its operations minus any capital and operating expenditure.

WHAT DO ANALYSTS AND FUND MANAGERS THINK?

Analysts Alastair Reid and Darren Milne at Investec believe the publisher’s business model has ‘structural attractions’ and continues to be ‘under-appreciated.’

‘Management note they see significant opportunities for acquisitions, with the ‘virtuous flywheel’ we have previously highlighted of cash generation and investment continuing to take effect, and the ongoing diversification strategy is increasingly smoothing profitability during the year, leading to a rebalancing of the dividend (in the first half now 3.7p).’

This view is shared by Eric Burns, lead manager at the CFP SDL Free Spirit Fund (BYYQC27). Despite the recent share price gains, Burns believes the stock is not expensive.

His fund has held Bloomsbury since 2019, and it is the fund’s biggest position at just over 9% of the portfolio.

‘There is no doubt that author Sarah J. Maas has turbo-charged Bloomsbury’s returns in the short-term. [However] over the long term it is a steady publisher which executes well and delivers strong returns. If you look at this year’s forecast there is a big step up, and if you look at next year’s it is set very conservatively and is not an example of the stock getting ahead of itself.’

Burns says: ‘It is our largest holding, and we are comfortable with that. If we look at [the company’s] free cash flow yield up to February 2025, it is just over 7%. We have a great business here and it is hardly expensive with such an attractive FCF yield.’

Important information:

These articles are provided by Shares magazine which is published by AJ Bell Media, a part of AJ Bell. Shares is not written by AJ Bell.

Shares is provided for your general information and use and is not a personal recommendation to invest. It is not intended to be relied upon by you in making or not making any investment decisions. The investments referred to in these articles will not be suitable for all investors. If in doubt please seek appropriate independent financial advice.

Investors acting on the information in these articles do so at their own risk and AJ Bell Media and its staff do not accept liability for losses suffered by investors as a result of their investment decisions.

Issue contents

Editor's View

Feature

Great Ideas

News

- Indivior enjoys a strong recovery as it targets primary US listing

- Halfords skids lower on weak demand and wet weather woe

- Is Adobe primed for an upside surprise?

- Competitive pressures are piling up for Pets at Home

- Will the Reddit initial public offering live up to investors’ hopes?

- Budget 2024: British ISA launched, booze duty freeze lifts pub stocks

magazine

magazine