Archived article

Please note that tax, investment, pension and ISA rules can change and the information and any views contained in this article may now be inaccurate.

It's worth paying up for quality compounder Experian

Credit checking group Experian (EXPN) has always been a premium-priced stock to own, and for good reason too.

It’s a business that has long since proven its worth through all market conditions, consistently showing itself to be highly cash generative with low capital intensity, underpinned by its high quality recurring revenues and remarkably consistent earnings throughout market cycles.

Even the coronavirus pandemic has failed to dampen expectations, and the company’s shares are at an all-time high after it last month raised its growth outlook for the second quarter ending 30 September. It now expects organic revenue to grow between 3% and 5% compared with its previous forecast of flat to minus 5%.

QUALITY SCORES

It is a clear quality business and scores well on the all right metrics with both a sector and market-beating operating margin of 22.8%, return on equity of 28.5% and return on capital of 17.8% according to Stockopedia.

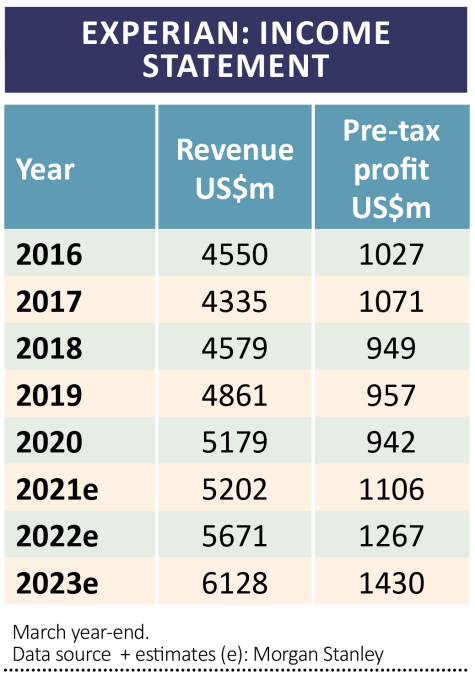

Its full-year results to 31 March, before most of the impact of the pandemic, had showed a solid growing business with revenue up 9% to $5.18 billion and pre-tax profit up 5% to $942 million. Earnings have subsequently held up very well.

In part, its ability to weather all conditions is because the biggest chunk of Experian’s customer base really need its services and, importantly, either can’t or don’t want to take the risk of getting them from elsewhere, underlying the importance of the business to its customers.

BUSINESS MODEL

According to its latest annual report, 39% of Experian’s revenue came from financial services, mostly from banks. The latter supply the company with raw credit history data for free, Experian aggregates it and applies analytics, then sells it back to the banks as a credit report for one or two dollars a report.

It’s an attractive business model for Experian and one of the reasons why high-profile fund manager Nick Train has decided to finally invest in the business, adding Experian to LF Lindsell Train UK Equity (B18B9X) portfolio.

Lindsell Train deputy portfolio manager Madeline Wright explains that Experian’s customer relationships in this area are very ‘sticky’, with renewal rates standing at around 90%.

This is because there are only two other players in this space – American giants Equifax and TransUnion. Competition is minimal as the banks use the services of all three, because the dataset owned by each of them varies.

There’s also little threat of a new entrant to the market given the tough regulation regarding such sensitive data, as well as the fact it would take a new player over 10 years to amass enough data to effectively compete.

GROWTH OPPORTUNITIES

Experian has 163 million business and 1.3 billion consumer credit history records.

What’s exciting analysts and fund managers now about Experian is some other aspects of its business which offer attractive growth opportunities.

Morgan Stanley highlights Experian’s direct to consumer segment, which has a membership base of 82 million and is currently the second largest contributor to revenue (15%) after financial services.

Analysts at Morgan Stanley forecast this division to bring in $1.9 billion by 2025, growing at an annual compound growth rate of 12%.

While barriers to entry are lower in this category compared to its business with the banks, Morgan Stanley believes Experian is gaining market share against its competitors, where website traffic data indicates it is catching up with market leader Credit Karma in the US.

Apart from the US and UK, its other key market is Brazil, where it has 67% market share and combined with recent investments gives it an advantage to capture structural growth, the analysts add. In Brazil alone they reckon changes to regulation and a macroeconomic tailwind could add $1.3 billion in revenue over 10 years.

BETTER USE OF DATA

Lindsell Train’s Wright highlights that Experian is undergoing an ‘active shift’ from simply selling data to selling data enhanced by decision tools, pointing out that right now 55% of its sales come from large databases of credit history from which reports are generated.

Advanced analytics and tools sitting on top of Experian’s datasets now account for 25% of revenues and, crucially, growing faster than its other data services, with this shift being the driver of substantial growth over the next decade.

RICH RATING

The business is generally considered by analysts as one of the safest growth compounders globally in the information industry.

Morgan Stanley adds: ‘We see scope for share buybacks to return from next year, which, along with steady dividend growth, should drive double-digit total shareholder return.’

It trades on a 12-month forward price-to-earnings ratio of 37.1 times. That’s a rich rating, but Experian has generally delivered consistent share price growth ever since listing in October 2006. It’s sometimes worth paying a high price to own the best and that applies to this stock.

Important information:

These articles are provided by Shares magazine which is published by AJ Bell Media, a part of AJ Bell. Shares is not written by AJ Bell.

Shares is provided for your general information and use and is not a personal recommendation to invest. It is not intended to be relied upon by you in making or not making any investment decisions. The investments referred to in these articles will not be suitable for all investors. If in doubt please seek appropriate independent financial advice.

Investors acting on the information in these articles do so at their own risk and AJ Bell Media and its staff do not accept liability for losses suffered by investors as a result of their investment decisions.

Issue contents

Editor's View

Exchange-Traded Funds

Feature

First-time Investor

Great Ideas

Money Matters

News

- Regulators on both sides of the pond size up big tech targets

- AIM index regains strength and US tech stocks rally again

- Leisure sector hit by Boris’ latest lockdown restrictions

- Vodafone could raise stakes in TalkTalk buyout battle

- Hipgnosis rival Round Hill Music to float new trust on UK stock market

- Forget tech, solar and clean energy is the hot sector in 2020

magazine

magazine