Archived article

Please note that tax, investment, pension and ISA rules can change and the information and any views contained in this article may now be inaccurate.

Shuffling the pack: How income funds are turning to different stocks for dividends

It’s been a tough year for people who rely on their investments for income thanks to widespread dividend cuts. Income fund managers have now rejigged their portfolios to names which they believe will be dependable source of dividends or bond coupons going forward.

Their changes make for interesting reading, particularly for anyone who prefers individual stocks to investment funds as it might throw up some ideas as to where the best income prospects lie.

SCALE OF DIVIDEND CUTS

‘Forecasts suggest UK dividends on aggregate for the market could be down between 30% to 50%’, explains David Smith, manager of Henderson High Income Trust (HHI).

He has taken a pragmatic view to dividend cuts, ‘supporting those companies I believe have the best long-term potential and capital recovery prospects, given their business model strengths and competitive positioning, despite no dividends in the short term, such as Whitbread (WTB) and Informa (INF).’

He has sold businesses that have cancelled dividends and where he has less faith over the medium-term recovery prospects or where structural or competitive pressures persist. Names that have left his portfolio include BT (BT.) and HSBC (HSBA).

To help limit the income hit, Smith has added to more defensive holdings such as Tesco (TSCO) and Reckitt Benckiser (RB.). He has also taken advantage of share price falls in more cyclical businesses with the balance sheet strength and cash flows to continue paying their dividends including 3i (III) and Rio Tinto (RIO).

The Janus Henderson Investors money manager says he has also materially increased the holdings in overseas companies, buying high quality names with good long-term growth prospects that ‘pay an attractive, sustainable and growing dividend’. Names that now have a more prominent position in his portfolio include semiconductor manufacturer Texas Instruments in the US and European utilities RWE.

INVESTMENT TRUST BENEFITS

One of the advantages of investment trusts is their ability to use revenue reserves to supplement income in more difficult dividend environments. ‘While that helps bridge the gap for income so the trust can maintain its own dividend, it means I can also maintain holdings in companies that have postponed their dividends to hopefully benefit from any capital recovery,’ adds Smith.

Charles Luke, manager of Murray Income Trust (MUT), says his fund’s focus on quality companies with robust balance sheets and resilient business models put the Murray portfolio ‘in a relatively strong position to cope with the falls in the market and the reduction in income generation that we have seen this year’.

Also aided by its substantial revenue reserves, Murray Income has been assisted by its ability to generate an additional uncorrelated income stream from an option-writing programme, says Luke.

His view is that income distributions across the market are likely to fall by around 40% this year, though his concentration on high quality companies means he expects the aggregate income flowing into his portfolio to be down only 15%.

He also expects those portfolio companies that have suspended their dividends to return quickly to the dividend list. ‘This is exactly what we are now seeing with the likes of XP Power (XPP), Close Brothers (CBG), Bodycote (BOY) and Mondi (MNDI) recently reinstating their dividends.’

DIVIDEND SUSTAINABILITY

Luke warns that during challenging times for income generation there is ‘the temptation to chase lower quality companies with the chimera of higher dividend yields’, but these dividends are ‘rarely sustainable in the long term’.

Instead, Murray Income has taken advantage of the market dislocation to add to companies with long-term earnings growth prospects such as Fevertree (FEVR:AIM), Dechra Pharmaceuticals (DPH) and Unite (UTG).

These purchases were funded by selling the likes of Royal Dutch Shell (RDSB) and HSBC before they cut their dividends.

SWIFT ACTION

Job Curtis, manager of City of London Investment Trust (CTY), describes his financial year to 30 June 2020 as ‘a year of two halves’.

In the first, ‘things went quite smoothly, the economy was chugging along with low inflation, the Conservatives won a decisive general election victory and that removed worries over sectors such as utilities’, but the second was turbulent to say the least.

‘Everything changed in January as the virus emerged in China, then spread to Europe and the UK. I really had to make some quite big changes to the portfolio.’

Curtis could see travel and leisure would be badly affected by the virus, so he sold TUI (TUI), Compass (CPG), Whitbread and Cineworld (CINE) and bought La Francaise des Jeux, the cash-generative French national lottery operator.

He also reduced exposure to banks. ‘I had bought Natwest (NWG) in 2019 but I subsequently sold it, and I also reduced HSBC, Lloyds (LLOY) and Barclays (BARC)’.

Banks have temporarily been stopped from paying dividends by the regulator, and while they have stronger financial constitutions than during the financial crisis, Curtis frets over the fact they remain ‘leveraged institutions vulnerable to a downturn in the economy’.

In oil, Curtis’ holding in Shell was reduced following its historic dividend cut and City of London bought into French international oil company Total, which he says has a lower cost of production than Shell and a stronger balance sheet.

Curtis also shuffled the pack in food retail, buying Tesco and Morrisons (MRW) while selling Sainsbury’s (SBRY) after it failed to pay its shareholder reward. In life insurance, he sold Aviva (AV.) and bought Legal & General (LGEN) ‘when they confirmed their dividend in April’.

When will banks resume dividends?

Banks across Europe stopped paying dividends this year following pressure from regulators to preserve capital during the pandemic.

An official update on when European banks might be able to restart payments is expected by the end of 2020.

Lloyds’ shareholders should brace themselves for significantly lower payments. The consensus analyst forecast is 1.53p in dividends for 2021, which is less than half the 3.37p paid for 2019. Analysts predict 2.41p in 2022.

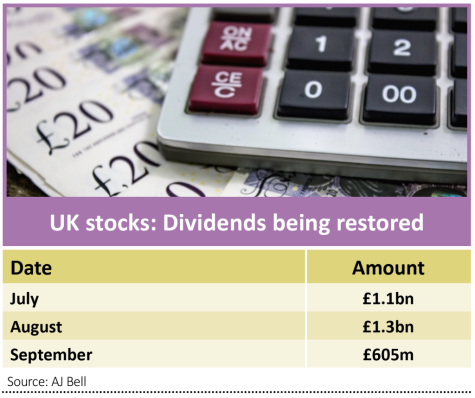

DIVIDEND RESUMPTION

Simon Moon, who manages the smaller companies portfolio of the Acorn Income Fund (AIF), recounts that during March, April and May, the period which happens to coincide with the most significant quarter of dividend declaration, a number of investee companies cancelled or deferred dividend payments.

‘This was predominantly a prudent act,’ insists Moon, ‘since the extent and duration of the economic disruption was uncertain and companies conservatively chose to prioritise liquidity.’

He says the recovery for many of these investee companies has been far sharper than expected and dividends have resumed accordingly.

‘In contrast, several large dividend payers further up the market-cap scale, that had been over-distributing dividends for years, used the same disruptive factors as an opportunity to reset excessive payouts at more sustainable levels, thus lowering their dividend outlook permanently,’ he adds.

Besides selling two indebted firms as the pandemic took hold, Moon used the volatility to top up numerous existing holdings and add other names to the portfolio. These included healthcare software provider EMIS (EMIS:AIM), fund manager Liontrust (LIO) and sausage skins manufacturer Devro (DVO), the latter demonstrating ‘cash flow solid enough to reinstate its final dividend’.

GOING GLOBAL

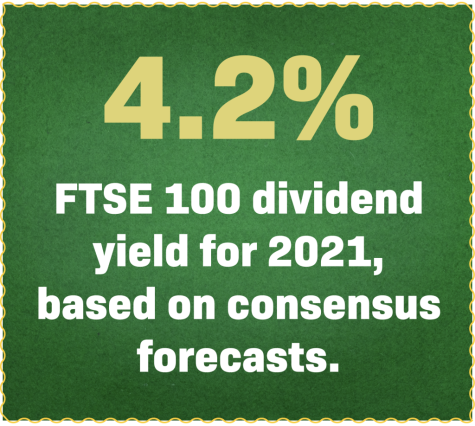

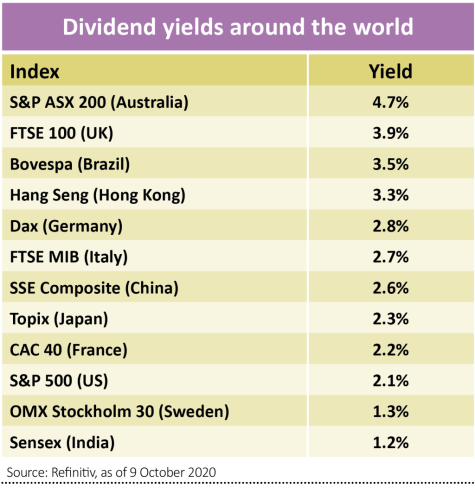

Murray International Trust’s (MYI) global mandate has been ‘very helpful in this difficult environment’ according to co-deputy manager Martin Connaghan, as it meant the fund wasn’t overly exposed to the UK or Europe, where dividend cuts have been much more severe than in other parts of the globe.

At the height of the volatility in markets, ‘when dividends were vanishing at very short notice’, Murray’s managers believed the most prudent course of action was to be relatively inactive. Since the market has settled down, portfolio activity has increased.

Investors’ obsession with the tech and e-commerce sector has led to numerous sectors and markets being overlooked, insists Connaghan, throwing up opportunities for those ‘prepared to stay focused and disciplined on relative value’.

In recent months, Murray International has invested in growth stocks including Abbvie, Ping An Insurance, China Resources Land, Hon Hai Precision, Unilever (ULVR) and Broadcom.

ASIAN OPPORTUNITIES

Coronavirus has caused dividend cuts around the world, though the scale of dividend losses in Asia is relatively smaller than in Western markets.

‘Even within Asia, better quality companies have had a better crisis,’ says Yoojeong Oh, manager of Aberdeen Asian Income Fund (AAIF), another trust sitting on significant revenue reserves. Hong Kong retailer Convenience Retail Asia ‘kept generating cash flow by quickly adapting its in-store products to suit the changing spending patterns during a tumultuous half year, which allowed the company to pay out a much welcomed special cash dividend in May’, she explains.

Technology and telecoms companies in Korea and Taiwan have emerged relatively unscathed from the worst of the pandemic, thanks to increased demand for electronic equipment and data stemming from the need to work from home.

Aberdeen Asian Income has used the last few months as an opportunity to add companies that could benefit when the tide turns, such as Singapore’s CapitaLand, and its subsidiary, CapitaLand Mall Trust, a retail-focused real estate investment trust with a suite of local downtown and suburban malls.

‘The REIT subsequently announced its merger with CapitaLand’s office unit to form a combined entity of well-located properties across the island state. Both new additions share robust income profiles and stable yields’, explains Oh.

BRAZIL’S ATTRACTIONS

Somerset Capital Management’s Kumar Pandit, who becomes co-manager of the Somerset Emerging Markets Dividend Growth Fund (B4Q0711) in November, believes Brazil offers a unique combination of income and growth potential.

‘Brazil is still 40% off its pre-pandemic peak in US dollar terms and is yielding 3.5% despite a wave of dividend cuts this year. Despite this, the economy has been hit less hard than many others – chiefly led by Bolsonaro’s refusal to implement a nationwide lockdown – and companies remain under-levered and well-placed to benefit from operating leverage when the economy recovers,’ says Pandit.

He adds that many companies have cut their dividends for good reason this year, but there is a strong culture of paying dividends in Brazil which bodes well for when the economic backdrop improves.

Also alive to opportunities is Brown Advisory, which bought more shares in Bank Rakyat earlier this year, highlighting its 5.4% current yield as attractive but saying the dividend is a bonus rather than fundamental to its investment decision-making.

Long owned in its Brown Advisory Global Leaders Fund (BYPJ0V0), the bank is ‘the undisputed leader in microfinance in Indonesia which is a key driver of its growth and high return on invested capital’, insists Priyanka Agnihotri, Brown Advisory’s head of international equity research.

Bank Rakyat’s key competitive advantages are its rural credit infrastructure and the system of incentives in its microfinance units which have been hard for other banks to replicate.

TWO INCOME FUNDS TO BUY

City of London Investment Trust (CTY) 325.5p

Yield: 5.8%

Over the 29 years to 30 June 2020, City of London has delivered a net asset value total return of 936% versus the 706% return from the FTSE All-Share.

Despite this year’s dividend cuts across large parts of the market, City of London raised the dividend for the year to June 2020 by 2.2%, partly funded by revenue reserves.

This marked a 54th consecutive year of increased payouts, the longest of any investment trust, and the board expects to increase the dividend in 2021 too, for a 55th successive year of rising shareholder rewards.

City of London’s three biggest holdings are consumer staples giants British American Tobacco (BATS), Unilever and Diageo (DGE), ‘global companies making everyday products with very good long term records, good cash generators, ideal as the bedrock of an income portfolio’ according to Curtis.

He says British American Tobacco’s profits have held up well during the pandemic and the stock offers a prospective 8% dividend yield. Such a high yield could be the market’s way of saying it doesn’t believe the dividend forecasts, which is something that investors should consider.

‘I’m a great believer in valuation coming through and you have seen more bid interest and stakebuilding going on in the UK market,’ explains Curtis. ‘The value may take time to be realised but we’re being paid while we wait’.

While predominantly a UK large cap trust, City of London has also increased its exposure to overseas listed stocks. It offers income seekers exposure to cash generators including Microsoft, Coca-Cola, Nestle and Johnson & Johnson.

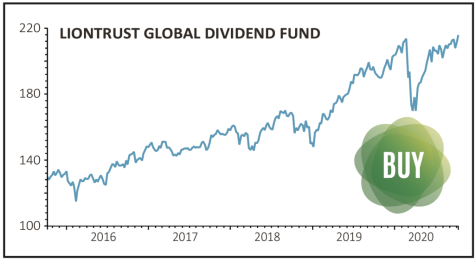

Liontrust Global Dividend Fund (B9225P6)

Yield: 3.7%

A savvy option for the new era of income investing is the Liontrust Global Dividend Fund (B9225P6), whose fortunes have been turned round since Storm Uru took over as manager in August 2017.

Rather than a high yield today, Uru focuses on dividend growth, a strategy he insists delivers a greater and more consistent level of income and total return to investors.

Uru invests in global leaders with economic moats and structural growth tailwinds which are well positioned to drive earnings and deliver attractive dividend growth.

A truly global fund, invested in 38 stocks spanning different sectors and countries, this is a portfolio of best-in-class businesses with strong competitive positions.

Uru says ‘economic profit is tipping the way of the best businesses in the world’ and he has some 130 global leaders on his watchlist.

A fairly new position is Disney, which cut its dividend in May in response to the pandemic-driven closure of its theme parks and is under pressure from activist Dan Loeb to suspend the dividend completely and invest the cash back into the business.

Liontrust’s Uru says the future economic prospects for the company is not its theme parks but its direct to consumer business like Disney+, Hulu and ESPN+. He also flags up Disney’s ‘fortress balance sheet with $27 billion of cash on hand’ and (before Dan Loeb’s intervention at least) expects Disney to return to dividend growth next year and provide investors with a steady stream of income for years to come.

The fund manager has also invested in Google-parent Alphabet, blessed with $120 billion cash on the balance sheet. ‘It is already buying back shares and it is only a matter of time before it initiates a dividend,’ says Uru.

Dividend growth stocks in the fund include credit card group Visa and industrial-to-consumer products maker 3M, ‘a stock that exhibits characteristics I’m looking for including an economic moat, high gross margins and a strong balance sheet,’ he adds.

Important information:

These articles are provided by Shares magazine which is published by AJ Bell Media, a part of AJ Bell. Shares is not written by AJ Bell.

Shares is provided for your general information and use and is not a personal recommendation to invest. It is not intended to be relied upon by you in making or not making any investment decisions. The investments referred to in these articles will not be suitable for all investors. If in doubt please seek appropriate independent financial advice.

Investors acting on the information in these articles do so at their own risk and AJ Bell Media and its staff do not accept liability for losses suffered by investors as a result of their investment decisions.

Issue contents

Editor's View

Exchange-Traded Funds

Feature

First-time Investor

Great Ideas

Money Matters

News

- Regulators on both sides of the pond size up big tech targets

- AIM index regains strength and US tech stocks rally again

- Leisure sector hit by Boris’ latest lockdown restrictions

- Vodafone could raise stakes in TalkTalk buyout battle

- Hipgnosis rival Round Hill Music to float new trust on UK stock market

- Forget tech, solar and clean energy is the hot sector in 2020

magazine

magazine