Archived article

Please note that tax, investment, pension and ISA rules can change and the information and any views contained in this article may now be inaccurate.

The US market presents a massive opportunity for Flutter Entertainment

The pandemic has accelerated the shift towards online gambling which provides a big opportunity for Flutter Entertainment (FLTR) to pick up new customers as they migrate away from physical arenas.

Because around 88% of the gambling market is still offline, there is plenty to play for, especially given that research shows retail brands retain less than half of their migrating customers.

The biggest growth opportunity lies in the US thanks to the Professional and Amateur Sports Protection Act (PASPA) of 1992 being overturned two years ago, allowing sports betting in the US. Some analysts have estimated the market could be worth between $30 billion and $35 billion.

WHO IS FLUTTER?

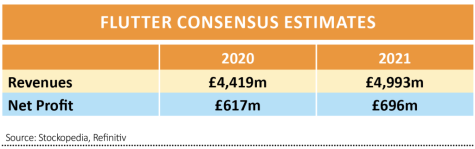

Flutter has grown by acquisition over the years to become the largest gambling company in the world with revenues forecast to be over £4.4 billion by the end

of 2020.

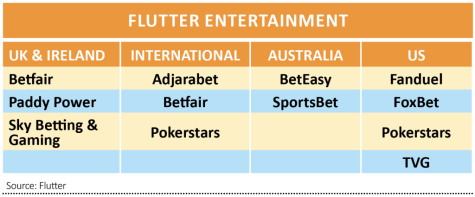

Flutter is organised across four regional divisions each with its own chief executive. The UK and Ireland division houses the Paddy Power retail chain, Betfair which is the world’s largest online betting exchange, and Sky Betting and Gaming which joined the group as part of the 2019 acquisition of Stars Group.

The international division is comprised of Betfair’s international business, the world’s largest real money online site PokerStars, and Adjarabet which is an online gambling company based in Georgia.

Australia is comprised of online bookmaker Sportsbet as well as BetEasy which became part of the group with the Stars acquisition. Flutter is in the process of migrating BetEasy customers to Sportsbet so that it operates under a single brand in Australia.

Lastly the US division consists of PokerStars’s US business, the largest US fantasy sports betting operation FanDuel, TVG (Television Games Network) which is the number one horse and greyhound racing operator, and Foxbet which is an online and mobile sports betting business.

PROFIT CONTRIBUTION

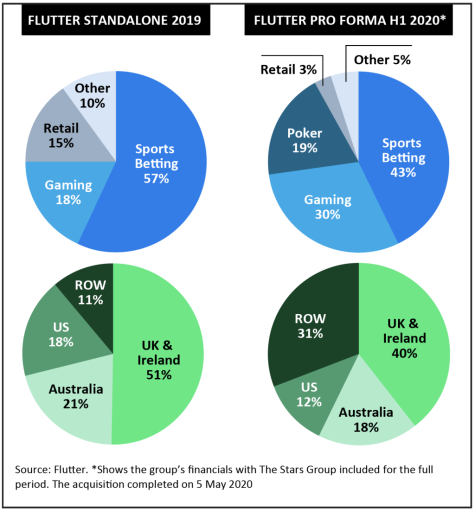

Revenues are split 50/50 between sports and gaming which provided a good counterbalance during the lockdowns when sporting events were cancelled with the loss of sports betting more than offset by an increase in gaming activity as people were stuck at home.

This can be seen in the first-half profit performance where the PokerStars business saw 67% uplift in EBITDA (earnings before interest, tax, depreciation and amortisation) to £380 million, increasing its contribution to total EBITDA to 55% from 45% in 2019.

Conversely the PaddyPower Betfair business, which is more dependent on sporting events, saw a 53% fall in EBITDA to £85 million, dropping its contribution to 12% from 34% last year.

An 18% increase in gaming revenue was not sufficient to offset a 21% reduction in sports leading to online revenue falling 8%. Meanwhile the closure of stores resulted in a £10 million loss in EBITDA.

The other piece of the UK division, Skybet sportsbook, Sky Vegas gaming business and Oddschecker saw EBITDA increase 66% to £184 million representing 27% of profits, up from 21% last year. The UK businesses represent around 40% of earnings.

Favourable sports results, a higher mix of UK football and reduced promotional spending during the Cheltenham Festival were the factors driving growth while sportsbook stakes fell 30% due to the cancelled events.

The Australian businesses grew online revenues by 45% as they benefitted from the temporary closure of retail shops. Stakes grew 18% in the first-half period helped by increased prominence of horse racing which is also a higher margin product. Overall EBITDA grew 84% to £121 million representing 17.8% of group profits.

How do bookmakers make money?

A good way to think about the bookmaking business is to consider a fair coin toss. The probability of heads and tails is 50% each, which means a fair price would put the odds at 2.0 for both. In other words, you bet £100 to win £100.

It’s not in the interests of a bookmaker to offer the true odds of an event. Instead they would price the coin toss market at 1.9, creating a margin of 5%. Over time the average bettor would lose 5p for every pound spent, which would be the bookmaker’s average profit.

Flutter owns Betfair which operates an exchange market where users bet against other users, removing the need for a bookmaker. This creates the possibility that bettors might get a better price than offered by a bookmaker.

Betfair charges a percentage of the winning bets to generate income. This business model is less risky because Flutter gets paid whatever the outcome.

US CONTRIBUTION

Flutter claims to be the only operator offering sports betting, daily fantasy sports, casino, poker and horse racing wagering in the US.

The US business is still loss-making with EBITDA losses of £19 million in the first-half period despite revenues growing 66% to £278 million. Strong growth in TVG horse racing thanks to greater TV coverage helped drive revenues while the substitution of gaming during lockdown increased gaming revenues by a whopping 380%.

For the full year the company expects to make an EBITDA loss of between £140 million and £160 million for the US arm, incurring extra costs related to online launches in Tennessee and Michigan in the second half.

FANDUEL’S IMPORTANCE

Flutter arguably has one of the best footprints in the US market and over the next few years the division may well become an important contributor to profits.

One of its key businesses which may not be as well known to UK investors is FanDuel, in which Flutter owns a 58% stake.

FanDuel and listed competitor Draftkings are the leading daily fantasy sports wagering businesses in the US. The idea behind daily fantasy sports is to create teams made up of real players from a professional sport and play against other users.

Once selected users play against each other for a single game or the entire season and earn points from how well their players perform. Each player has a different salary based on how they are likely to perform and each user is given a fixed budget to select their teams. The attraction for users is the chance to relive the excitement every game without being stuck with the same players.

FanDuel makes money by collecting a percentage of user entrance fees with the rest going to the pool which is paid out to the winners at the end of each game or season. FanDuel also makes money from selling advertising. The company runs a sportsbook across six states online and 10 including retail locations.

Flutter reckons it was the leading sportsbook operator in the markets it operates with a 44% market share in the first half of 2020, ahead of Draftkings at around 34%.

Last year Draftkings listed on the Nasdaq market and today has a market capitalisation of almost $20 billion despite being loss-making, trading on 27 times 2021 expected revenues.

Breakdown of Flutter's earnings

There are clear benefits to be had from Flutter Entertainment’s purchase of The Stars Group such as a broader geographically footprint and a better diversified product offering.

VALUATION IMPLICATIONS

DraftKings’ shares are up over 350% so far this year, underlining US investor interest in online sports gambling.

By applying DraftKing’s valuation to FanDuel and FoxBet and putting a conservative value on Flutter’s non-US businesses Jefferies calculates an implied valuation of around £160 for Flutter, around 26% higher than current levels.

Taking the business as a whole, Jefferies estimates Flutter trades on a 2021 free cash flow yield of 3% which, it says ‘appears a full valuation but the opportunity in the US will create material value in the longer term, in our view’. Shares has a ‘buy’ rating on the stock.

Important information:

These articles are provided by Shares magazine which is published by AJ Bell Media, a part of AJ Bell. Shares is not written by AJ Bell.

Shares is provided for your general information and use and is not a personal recommendation to invest. It is not intended to be relied upon by you in making or not making any investment decisions. The investments referred to in these articles will not be suitable for all investors. If in doubt please seek appropriate independent financial advice.

Investors acting on the information in these articles do so at their own risk and AJ Bell Media and its staff do not accept liability for losses suffered by investors as a result of their investment decisions.

Issue contents

Editor's View

Exchange-Traded Funds

Feature

First-time Investor

Great Ideas

Money Matters

News

- Regulators on both sides of the pond size up big tech targets

- AIM index regains strength and US tech stocks rally again

- Leisure sector hit by Boris’ latest lockdown restrictions

- Vodafone could raise stakes in TalkTalk buyout battle

- Hipgnosis rival Round Hill Music to float new trust on UK stock market

- Forget tech, solar and clean energy is the hot sector in 2020

magazine

magazine